ato are raffle tickets tax deductible

To claim a deduction you must have a written record of your donation. 445 8 votes.

Top 12 Forgotten Ato Real Estate Tax Deductions Propertyme

Generally if the raffle is for a charitable purpose and the tickets are.

. Are Raffle Tickets Tax Deductible Australia. Costs of raffles bingo lottery etc. Not all charities and not-for-profits are DGRs.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Although raffles tickets are a form of donation they are not tax deductible. Yes a taxpayer who carries on a business is entitled to a deduction under section 8-1 of the Income Tax Assessment Act 1997 ITAA 1997 for an outgoing.

Call the ATO Indigenous Helpline on 13 10 30 or visit ato govauIndigenous for more information about support services. On october 31 2004 the Will gst be payable on the revenue from the proceeds of the sale of raffle tickets. When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their.

Meaning that those who are married and filing jointly can only get a 300. You cant claim gifts or donations that provide you with a personal benefit such as. This is because the purchase of raffle.

For example a business owner may not deduct tax penalties. 11122021 A tax deductible donation is an amount of 2 or more that you donate to a charity that is registered by the. Further conditions for a tax-deductible contribution.

August 30 2021 1751. The answer depends on a few factors including the value of the tickets and the purpose of the raffle. For 2020 the charitable limit was.

300 per tax unit. What is the limit on charitable deductions for 2020. A DGR is an organisation or fund that is endorsed by the ATO to receive tax deductible gifts or donations.

No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372. However pins tokens wristbands and stickers are deemed by the ato as having no material value and are used by the dgr as. Advertisement Fines and penalties a business pays to the government for violation of any law are never deductible.

The Australian Taxation Office ATO continues to provide free tax. What you cant claim.

Common Tax Issues Associated With Making Donations Wolters Kluwer

Houston Police Officers Union There Will Be A Bbq Benefit For The Family Of Officer Homer Teran Who Recently Passed Away Due To An Unexpected Illness The Benefit Will Be On

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Top 12 Forgotten Ato Real Estate Tax Deductions Propertyme

The Farm Sea To Farm Real Estate

Tax Deductible Donations Reduce Your Income Tax The Smith Family

Cryptocurrency Tax Dodgers Beware Of Operation Hidden Treasure

A Guide To Charitable Donations

Hope Golf Tournament The Speedy Foundation

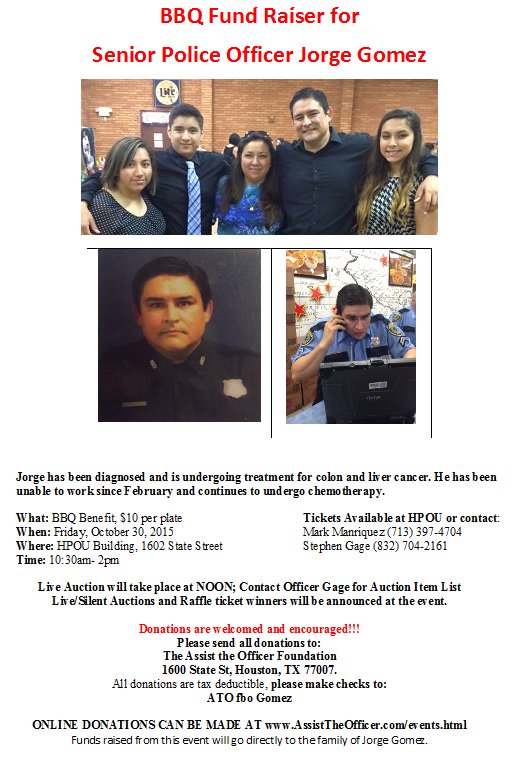

Houston Police Officers Union On Twitter Fundraiser For Jorge Gomez Is Fast Approaching Join Us To Fight Against Cancer Oct30th 10 30am 2pm 1602 State St Https T Co Scasovx3s0 Twitter

Top 60 Business Mistakes During Tax Audits In 2021 Ads

Event Recap Our First Fundraiser At The Strand Theatre Cameron S Crusaders

9 Deductions Most Likely To Get You Into Trouble With The Taxman

Long Beach Herald 07 14 2022 By Richner Communications Inc Issuu

Example Case Study 2 Australian Taxation Office

Crypto Staking Taxes Ultimate Guide Koinly

Taxpack 2011 Supplement Australian Taxation Office

Are Nonprofit Raffle Ticket Donations Tax Deductible

Donations What S Tax Deductible What S Not Canberra Citynews